In this case, the OFX format is recommended. Look for the link 'Import a bank statement to get started' and click on it. This is not an actual Payee from the OFX file. The Payee name did not assign because this is Vendor Record that you have to select in Quickbooks. Once the transactions are imported, you can review, categorize them under the account and add them to the register. Click the 'Save and Close' and 'Next' buttons. Select the Account Type, choose Detail Type (in our case Bank and Checking Account). Then select an account or add new to import and click 'Next'. Then click the 'Browse' to locate your OFX file. In your accounting software, look for 'File Upload, 'Import a statement', 'Upload a bank file' or similar links to upload created OFX file. Click the 'Upload transactions manually' button. Now the OFX file is created, let's switch to Quickbooks Online and import created OFX file.

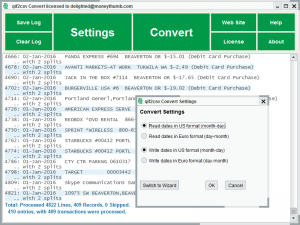

Import created OFX file into Quickbooks Online Set the Account ID (number) and the Account Type.Īlso check Currency, End balance, Bank ID, and Branch ID.Ĭhoose the OFX target to better work with your accounting software or use the "Regular OFX" option.Ĭlick the 'Convert' button to create an OFX file. Make sure expenses are negative and deposits are positive.

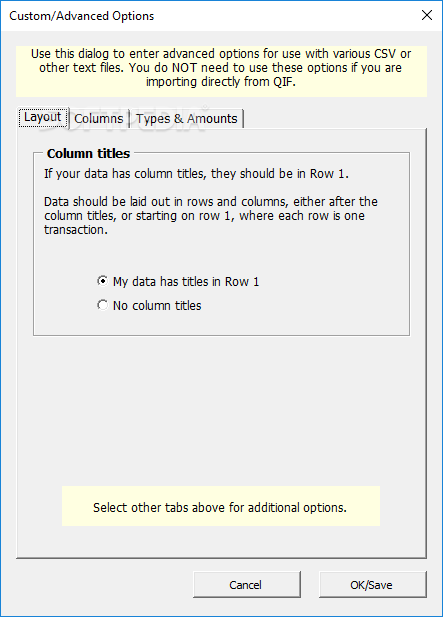

Review transactions before converting, reassign columns if needed. Download it from the CSV2OFX download page. Make sure you are using the latest version of CSV2OFX.

Follow the steps below for the Windows version, followed by the Mac version.

0 kommentar(er)

0 kommentar(er)